A retrospective on the Chinese baby formula market between 2010-2014

The Chinese baby formula market is a massive market that is only expected to become even bigger than ever due to relaxed birth control policies. It is worth noting however that the melamine milk powder scandal in 2008 had a lasting impact on Chinese consumers, to the point where international brands were preferred over domestic brands out of fear, a phenomenon that is still happening today despite numerous efforts by Chinese companies to redeem their brands. The combination of such scandals in the milk powder industry and recurring food safety scandals in other industries led Chinese consumers to purchase baby formulas from foreign sources with the result being a rise in controversial actions by Chinese consumers in foreign countries, with countries instating various methods to block Chinese consumers from buying in bulk and disrupting supplies.

The problem still persists today, and has only deepened as Chinese consumers still continue to prefer international brands over domestic equivalents despite the fact that 11 years have passed since the incident. Several other incidents such as the sales of fake baby formulas which occurred as recently as 2017 have only worsened the distrust towards domestic brands and have kept the memory of the incident alive.

Demand for baby formulas and top selling brands

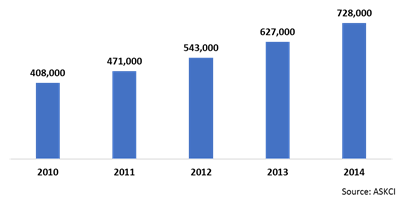

A total of 727,800 tons of baby formula were sold in retail in 2014, a year-on-year growth rate of 16.04%. Market growth had reached its highest since 2010, when year-on-year growth rate was 17.65% before dropping to 15.43% in the following year.

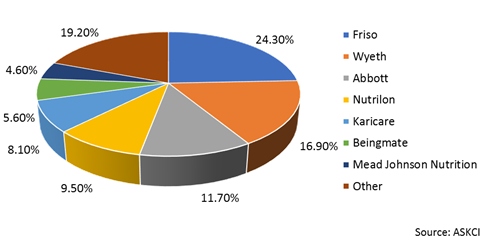

Top selling baby formula brands on B2C platforms in 2014 included Friso, Wyeth and Abbott, all of which are notable foreign baby formula brands. The brands listed in the figure below with the exception of Beingmate, which represented a mere 5.6% of the market compared to other brands, are all foreign brands, showing that Chinese consumers were heavily inclined towards foreign brands due to the milk powder scandal.

Sanlu: one of many other culprits and the fallout of the scandal

While the incident is known to the outside world as the 2008 Chinese Milk Powder Scandal, the scandal is referred to as the ‘Sanlu Incident’ in China, and as a result the name ‘Sanlu’ has become synonymous with shady practices for the sake of higher profits in food and other industries in China.

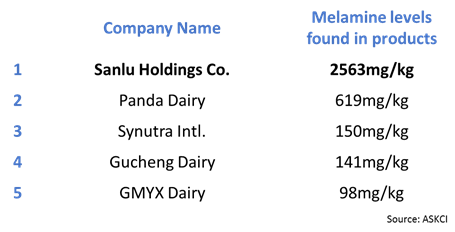

As reported by Xinhua News Agency, the presence of melamine in Sanlu products prompted the launch of an industry-wide investigation. By the time the investigation was concluded, over 80 different companies were investigated, with a total of 22 different companies including industry giants Mengniu and Yili found to be producing milk powder products contamintated with different levels of melamine. Sanlu in particular, was guilty of producing baby formula products with the highest level of melamine contamination with a staggering 2563mg/kgs of melamine found in its products. This combined with Sanlu’s status then as a market leader with almost 20% of market share caused widespread kidney failure amongst children, hence the 2008 Chinese Milk Scandal’s Chinese name.

The melamine-laced baby formulas led to a minimum of 300,000 cases of melamine-poisoning related illnesses and claimed 6 casualties. Not all affected children were able to seek appropriate treatment, causing victims to suffer from ill effects to this day, with the direct result being irrepairable damage to the reputation of Chinese baby formula brands.

Parents in search of better alternatives began to look towards imported baby formulas to feed their children, and due to then-available channels being unable to cover the demands of Chinese consumers in their entirety, this gave way to the ‘Dai Gou’ phenomenon, where individuals or syndicates based in foreign countries purchased baby formulas from foreign channels on the mothers' and sell them to mothers in China at inflated prices. Said channels were typically supermarkets, stores and drugstores located in foreign countries, and while this briefly led to an increase in profits for foreign companies, over-consumption and the resulting supply disruptions resulting in local parents being unable to find any products for their own children led foreign distributors to impose regulations on the amount of baby formulas a customer may buy, an example being Japanese stores limiting the purchase of milk powder by Chinese tourists to two cans per passport.

The cause of the problem: a lack of moral standards

As corroborated by many different sources including official and non-official sources such as Xinhua News Agency and the SCMP, ongoing health and food safety scandals are in large parts indicative of China’s lack of moral values which led to the present state of people blindly pursuing profits with the sale of counterfeit products made using cheap materials and sold at inflated prices. While incidents such as the Sanlu Incident may serve to jolt the Chinese collective conscience once in a while, the number of Chinese food safety incidents that have happened since 2008 makes it clear that China still has a long way to go in terms of moral improvements.

This does not mean however, that China has learned nothing from its mistakes. Aforementioned companies such as Mengniu and Yili have made great efforts to improve product quality and are now subject to safety standards even higher than the international norm. 3 individuals involved in the Sanlu Incident were sentenced to life in prison, 2 indivuals were given death sentences, and despite the fact that Sanlu had filed for bankruptcy by the time, the company was fined a total of CNY 50 million. The Chinese government continues to deal harshly with people involved in the production and subsequent sales of counterfeit foods in an effort to curb such problems.