Smartphones in China: the decline of international brands and the ‘Big Four’

July26, 2019

ByDaniel Choi

Overview

Despiteits’ humble beginnings, the Chinese mobile phone market has eventually grown toa point where smartphone penetration rates alone were at 50%, a figure that isexpected to grow to 61% by 2023 (Statista, 2019). Besides smartphones,substantial markets for feature phones for the elderly and smart watches withtelecommunication functions designed for schoolchildren do exist. Thesmartphone market is expected to increase its overall market share andeventually begin to encroach upon the market share of the aforementionedmarkets however.

Whileforeign smartphone brands were very common during the early years of theChinese smartphone market due to technological gaps between Chinese and foreigncompanies, Chinese smartphone companies have gradually caught up to theirforeign contemporaries and have been competing on even ground.

A saturated market with risingnationalistic tendencies

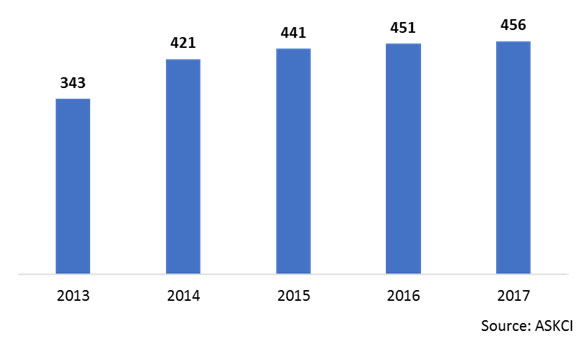

TheChinese smartphone market recorded a total of 456 million smartphones sold in2017.Market saturation however has caused smartphone sales growth to slow downto a fraction of its former pace.

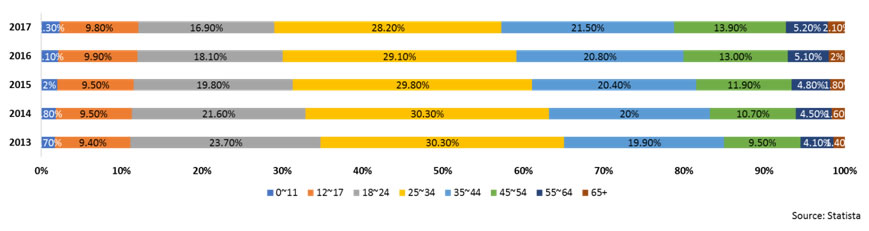

Observations from smart phone distribution by agegroups reveal that the population between 18 to 44 years of age possess themajority of smartphones in China. The age group between 25 to 34 in particularhas never dropped below 28% in distribution, while the age group between 18 to24 has seen a recession. The distribution rate for the age group between 45 to54 has been growing steadily since 2013 and is the age group to experience thelargest amount of growth. The distribution rate for the age group above 65 hasbeen growing albeit slowly, which reflects a previous statement regarding theencroachment of the smartphone market on the feature phone market.

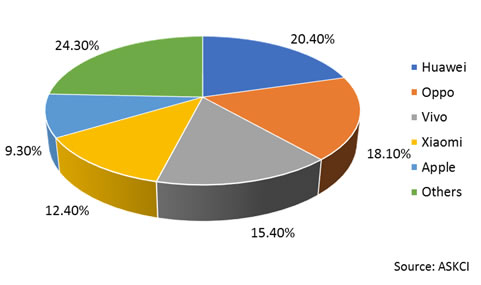

The Chinesesmartphone market in 2017 was dominated by the ‘Big Four’ domestic smartphonebrands, namely Huawei, Oppo, Vivo and Xiaomi. Apple was the only brand amongstthe top 5 to be aninternational brand. Smartphone brands under ‘Others’included internationally renowned brands such as Samsung, HTC and Sony. The‘Big Four’ brands combined took a total of 66.3% in market share in 2017, andby multiplying this figure with the total amount of smartphones sold in 2017,this would indicate that the ‘Big Four’ sold a combined total of 302.3 millionsmartphones, and if Chinese brands under the ‘Other’ category were counted aswell, the total number of Chinese branded smartphones would be even higher thanthe aforementioned figure. This leads to the conclusion that Chinese consumersprefered Chinese smartphones over foreign contemporiaries by a large margin in2017.

These statistics when combined with historical data indicatethat as Chinese companies slowly begin to catch up in technological aspects,Chinese consumers are beginning to migrate to Chinese brands. As previouslymentioned, the only international brand to retain a significant amount ofmarket share in 2017 was Apple, while other major international brands were allincluded under the ‘Other’ category, which means that they did not retain anamount of market share deemed adequate to be listed separately. Based upon thisit is reasonable to consider the possibility of international brands havingretained a combined market share of over 15% to be extremely low in 2017. Recentinternational events, cheaper prices and custom-tailored features and operatingsystems for Chinese consumers are some of the main drivers of market sharegrowth. Recent international events in particular are expected to havediminished market share of international brands such as Apple to historic lows.

Observations regarding Chinese brands

Duringthe early years of the smartphone in China, Chinese smartphone companies’products were largely inferior to those of international brands, whichjustified the higher prices international brands charged for their products.However, 2017 was a year of significance to the Chinese market. While Chinesesmartphone technology had already caught up to international contemporaries,the news of the Samsung Galaxy Note 7 and defective battery induced hardwareproblems, along with the long rumored $1000 price tag for the iPhone X provedto be the tipping point for Chinese consumers. In other words, Chinesesmartphones offered technologically sound smartphones made by Chinese companieswith Chinese features for the Chinese market at a price range that Chineseconsumers deemed acceptable, something international brands failed to do.Samsung has never recovered its market share in China since 2016-2017, and itsGalaxy C range of smartphones have all but disappeared off the market. WhileApple’s smartphones have not declined so rapidly, it is expected to go down thesame route as Samsung as long as product prices remain high, and with recentinternational events in play, that would mean that Apple faces a two-layeredbarrier of prices and politics. While Apple could ostensibly do somethingregarding prices, albeit at the risk of damaging its own reputation, politicsare a much taller obstacle for Apple to conquer.