The Chinese Plush Toy Industry: A Look Back to 2009-2014

July24, 2019

ByDaniel Choi

Overview

Whiletoys were a common sight throughout the history of China, the modern toyindustry in China only began during 80s after the Chinese Economic Reformsduring the end of the 70s. The plush toy industry also began during the sametimeframe, and changes in China’s living standards and the growing amount ofdisposable income available to Chinese households along with changes in the wayplush toys are used have led to high sales revenues.

Alongsidetheir main use as Children’s Toys, plush toys have also been used as softfurnishings in homes, offices, public spaces and have also seen use as vehicleaccessories

Plush toy sales and consumer characteristics

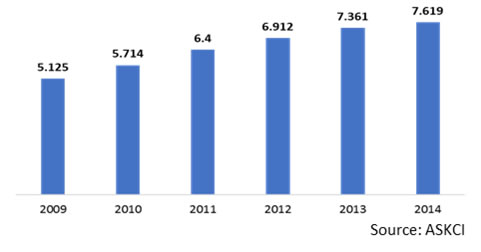

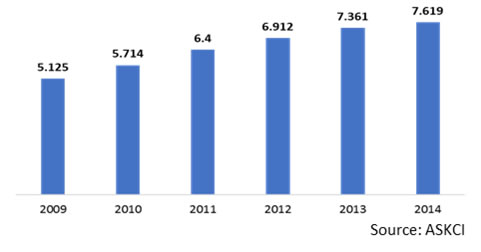

TheChinese plush toy market recorded a total of 7.619 billion CNY (1.10841 billionUSD as of July 18th2019) in retail sales at a CAGR of 3.5% in 2014.Growth rates remained fairly steady during the five-year period shown here.

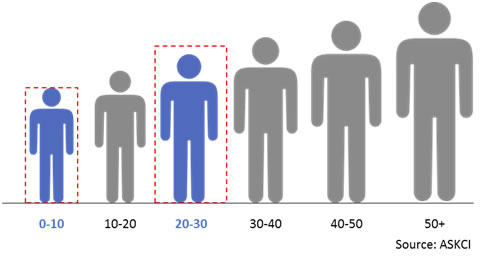

While exceptions doexist, plush toys are usually made for children between the age of 0 to 10.Young adults and parents between the age 20 to 30 however are the mainconsumers as they buy plush toys for their children, who do not possess anyspending power, and themselves for purposes such as home, office or vehicledecoration.

Industry characteristics and wholesalecenters

Despite the fact that China has a large number of plush toybrands and companies, children are know to prefer foreign brands over Chinesebrands as Chinese children usually find foreign brands and products to be moreappealing due to the prevalence of appealing designs and an adherence to thelatest trends. The large majority of Chinese plush toy companies are OEMcompanies and thus do not have a powerful brand of their own, hencecontributing to Chinese childrens’ preferences for foreign toy brands.

According to primary research data, it is known that the 5largest wholesale centers are located in Liaoning, Henan, Zhejiang, Guangdongand Sichuan Provinces, while a majority of plush toy companies are located inShandong, Fujian, Guangdong, Jiangsu, Zhejiang Provinces and Shanghai. It isworth noting however that according to research-based estimates, around 80% ofthese companies are OEM companies, which leaves only 20% of companies topossess their own brands.

While the described situation was from a look back at theindustry from 2009 to 2014, it has seen little improvement since then; based on this, the logical step for Chinese plush toycompanies would be to create stronger brands and use the power of precisionmarketing to cultivate a loyal customer base to reverse this situation.