New Energy Vehicles (NEVs) in China: Industry Data and Insights

July25, 2019

ByDaniel Choi

Overview

Theindustry for Electric Vehicles, also known as ‘New Energy Vehicles (NEVs)’ inChina is currently developing at a pace faster than that of its contemporaries,driven largely by national policies detailed in the 13thfive-yearplan designed to accelerate the adoption of NEVs in China, which themselveswere created in response to the opportunities present in the industry itselfalongside China’s ongoing environmental problems, of which pollution isconsidered a major issue. While the NEV adoption rate amongst the civilianpopulation still leaves ample room for improvement, public transportation suchas buses and taxis in China’s largest cities have largely been converted toNEVs as part of national directives.

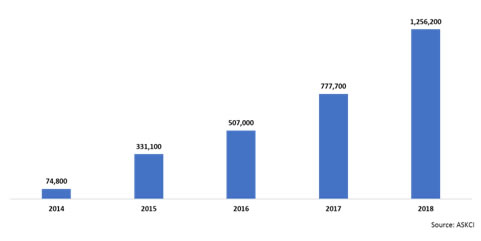

Sales figures and sales composition: overa million units sold in 2018

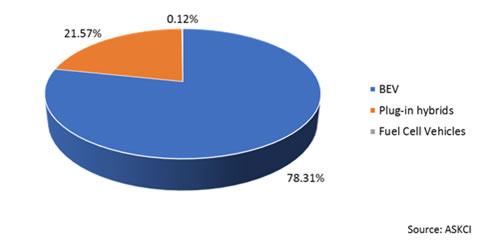

Chinese consumers displayed a markedpreference for Battery Electric Vehicles (BEVs) in 2018 according to the sales statisticsshown above. Fuel Cell Vehicles (FCVs) are the least popular of the main NEVtypes available for purchase in China due to the lack of supportinginfrastructure. This however, is a hardly a problem that is exclusive to FCVsalone.

The main problem with NEVs in China

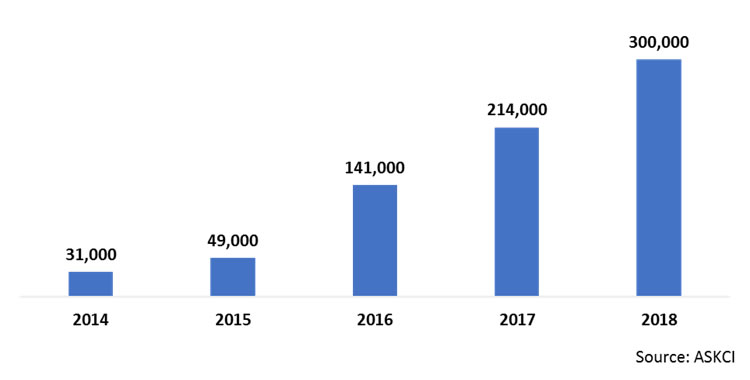

WhileNEV sales have already crossed the million-unit mark, infrastructureconstruction remains slower than expected with a total of only300,000 charging polesavailable all over the country.While initial reactions may lead to the conclusion that there is a lack ofcharging poles, other data proves otherwise.2

Areview of the top 5 cities and provinces with the greatest number of chargingpoles indicates thatBeijingis the location with thehighest number of charging stations, followed by Shanghai with a2,341 difference. These two cities alone account for roughly27%ofall charging poles in China. The rest of the top 5 areas are provinces thatwhen combined, account for roughly29%of all charging poles inChina. This means that thetop 5 areas with thehighest number of charging poles account for roughly 56% of all charging polesacross the country,and thus leads to the argument thatunevendistribution, rather than quantity is the main problem. This is supported bynumerous news articles and Chinese forum posts about NEV owners bemoaning thedifficulty of locating charging poles in their areas.

Asseen in the above graphic, these numbers mean that 56% of all charging stationsin China are found in areas that amount to less than 5% of China's total landarea. All five areas are located near the Chinese coastline and thus means thatthe rest of China continues to use traditional vehicles due to the lack ofsupporting infrastructure. The dominance of BEVs in the Chinese market meansthat the lack of infrastructure support represents a serious deterrent to NEVpenetration rates as BEVs rely completely on electricity unlike HEVs.

Investment opportunities

Thishowever, means that there is a massive untapped market in the rest of China forforeign and domestic investors alike. Charging stationsuppliers, manufacturers and NEV companies should aim at entering the untappedmarket for NEVs in such locations as soon as possible while beneficial policiesare still in effect.

Notable Companies